Lloyd's Market

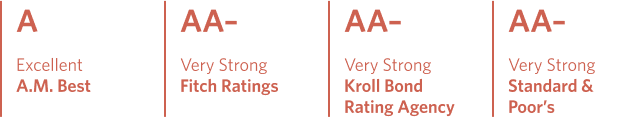

Lloyd’s, with its headquarters in London is the oldest insurance market in the world. Its history continues for more than 300 years and it has confirmed financial strength from all global rating agencies.

Lloyd's is the world's largest specialist insurance market, bringing together the most innovative underwriters from around the world. This allows Lloyd's to offer unique insurance solutions even for the most demanding clients.